Mastering Price Elasticity:

From Estimation to Optimization

In today’s data-driven world, pricing isn’t just an art, it’s a science. At the core of this science lies price elasticity, a powerful metric that helps companies understand how price changes influence demand and, ultimately, revenue. Whether you’re launching a new product, running a promotion, or fine-tuning dynamic pricing strategies, mastering elasticity is key to making informed and profitable decisions.

Why Price Elasticity Matters

Price elasticity quantifies how sensitive your customers are to price changes. It enables you to:

- Optimize pricing for profitability and market share

- Support data-driven decision-making over gut feeling

- Benchmark against competitors more effectively

- Fuel dynamic pricing engines, particularly in AI-driven environments

How to Estimate Price Elasticity

There’s no one-size-fits-all method to calculate price elasticity. Here’s an overview of the most effective techniques, each suited to different contexts and data availability:

1. Expert Opinion

- Definition: Insights gathered from industry experts

- Pros: Quick, intuitive, helpful for new or niche products

- Cons: Subjective, not scalable, lacks real-time accuracy

- Best use: Early-stage launches or specialized markets

2. Market Surveys

- Definition: Consumer-based studies to assess willingness to pay

- Methods:

* Van Westendorp Price Sensitivity Meter

* Gabor-Granger Pricing

* Conjoint Analysis

- Pros: Directly captures customer perception

- Cons: Time-consuming, may suffer from bias

- Best use: Premium product research and pricing strategy validation

3. Experimental Techniques

- Definition: Testing different prices in real-market settings

- Types:

* A/B Testing: Real-time evaluation of price points (e.g., Amazon, Netflix)

* Reinforcement Learning: AI-driven continuous price adaptation (e.g., Uber, Walmart)

- Pros: Reflects real behavior, adaptable, scalable

- Cons: Requires technical setup and data volume15

4. Hedonic & AI-Based Pricing

- Definition: Uses statistical or machine learning models to estimate how various product features impact price

- Pros: High accuracy, automation-ready

- Cons: Requires expertise and large datasets

- Best use: Real estate, electronics, automotive

5. Transactional Data Analysis

- Definition: Uses historical sales and pricing data

- Pros: Scalable, objective, real-time compatible

- Cons: Needs stable market conditions and clean data

- Best use: Retail, CPG, and e-commerce industries

From Data to Decisions: The Transactional Method in Action

Using past sales data remains one of the most scalable and actionable ways to estimate price elasticity. Here’s the typical flow:

1. Data Collection: Collect price and sales volume data at the appropriate level of granularity

2. Data Cleaning: Remove outliers and adjust for seasonality

3. Segmentation: Organize data by channel, geography, or customer segment

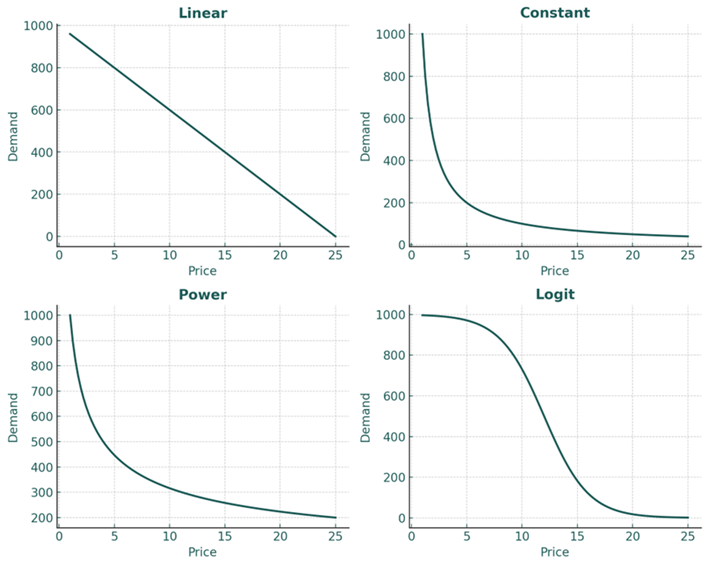

4. Apply four empirical regression types commonly found to best fit real-world price–demand relationships:

- Linear – assumes a constant rate of change in demand with price.

- Constant Elasticity (Log-Log) – often used when elasticity is expected to remain stable across price levels.

- Power – captures diminishing demand sensitivity at higher price points.

- Logit – models S-shaped demand curves, useful when there is saturation or strong price thresholds.

These regression families are empirically effective across industries and product types. Running all four enables selection of the best-fitting model for robust elasticity estimation.

This is particularly valuable in retail, CPG, e-commerce, and pricing analytics where different SKUs behave differently.

5. Model Selection: Choose the most statistically sound model

6. Elasticity Calculation: Identify how demand changes in response to specific price changes

Key Concept: The Volume Hurdle

One unique output of transactional price elasticity analysis is the Volume Hurdle — the minimum volume increase needed to justify a price decrease or the maximum volume loss tolerated when increasing prices, while still protecting profitability.

For example:

A 5% price drop on a product with a 25% margin requires a 16.67% increase in volume to break even.

Conversely, a 5% price increase can tolerate up to a 25% drop in volume without hurting margins.

Why elasticity matters:

Elasticity tells you how realistic these volume changes are. If your elasticity estimate suggests that demand will only rise by 5% after a 5% price cut — but your volume hurdle requires a 16.67% increase — then the price cut is likely unprofitable. Conversely, if raising the price is expected to lead to only a minor drop in demand, the increase may be a smart move.

In short, elasticity bridges the gap between theoretical financial thresholds and actual market behavior, making the Volume Hurdle a truly actionable pricing tool.

Looking Ahead: The Future of Elasticity Modeling

As pricing analytics matures, elasticity modeling is becoming more robust, nuanced, and business-aligned. New advances are emerging from three major methodological families:

Causal Inference Methods

These approaches aim to isolate the true causal effect of price on demand, controlling for confounding variables such as seasonality, promotions, or competitive actions. This helps ensure that observed demand shifts are truly attributable to pricing decisions — not external noise.

Machine Learning Models

Nonlinear modeling techniques, such as decision tree ensembles or regularized regressions, can handle complex price-response patterns across large and fragmented product portfolios. These models are particularly useful when traditional assumptions about elasticity no longer hold, allowing for more adaptive and scalable insights.

Choice and Behavioral Modeling

Methods grounded in utility theory, such as logit-based models, capture how consumers make trade-offs between alternatives. These are especially powerful when pricing decisions need to reflect brand hierarchy, product substitution, or differentiated customer preferences.

In parallel, pricing leaders are expanding the scope of elasticity analysis through:

- Cross-Price Elasticity: Understanding how the price of one product influences the demand for another — crucial for product line strategy and category management.

- Promotional Elasticity: Measuring the short-term lift from discounts and campaigns, which is key for optimizing promotional investments.

- Competitive Elasticity: Evaluating how changes in relative market prices affect demand dynamics — essential in dynamic or commoditized markets.

Together, these developments are transforming elasticity modeling from a static metric into a dynamic tool for strategic decision-making.

Conclusion

Price elasticity is more than a number — it's a strategic compass. Whether through surveys, experiments, or AI-powered analytics, the ability to understand and anticipate demand reactions can redefine your pricing power.

By integrating elasticity analysis into your pricing processes, you're not just adjusting prices, you’re optimizing your profitability, sharpening your strategy, and future-proofing your business.

Jeanny Consulting - Your pricing

expert that makes it personal.

contact@jeannyconsulting.com

+32 3 450 86 69

Veldkant 33B

2550 Kontich

Belgium

© The Odd Bunch